An Introduction to Professional Indemnity Insurance and how we can help you

What is professional indemnity insurance?

Professional indemnity insurance (or PII) is a type of insurance policy frequently held by professionals to protect against losses or damages. As it applies to claims which may arise from negligence or malpractice, professional indemnity insurance cover is most common in the legal and medical professions. It is also a legal requirement for multiple industries.

Who needs professional indemnity insurance?

There are a number of reasons why your business may require PII. Whether it be that your business provides professional services, you access confidential information about customers, or if there are any opportunities through your work for clients to open claims of professional negligence against you. It is a form of business insurance that covers the cost of legal fees.

Why is it necessary?

The Solicitors Regulation Authority (SRA) Indemnity Insurance Rules put forward the requirement for professional indemnity insurance; therefore, all new firms must have it in place before they can practise. PII is in place to cover civil liability claims.

If a client files a claim of professional negligence against your business, PII protects your business’ principals. In the case of solicitors, this is the most common claim.

A lack of cover means that claims can be taken from the principals of your private legal practice. This is also including interest. If this were to happen, it could result in a massive penalty to the business. This is why it is important to mitigate this through using PII.

What PII isn’t for

It is important to note that PII does not cover property damage. PLI (Public Liability Insurance) is the correct option here, suitable for businesses that may visit properties, or work on publicly open sites. Additionally, if you are aware of any potential claims against you, the policy will not cover that claim if you did not take it out before becoming aware. It is also worth noting that criminal acts or intentional wrongdoing are not covered.

Pressures and trends in the market

The nature of PI insurance means that it is subject to change. For example, accountants faced claims due to changes in regulation, such as the modification to HMRC’s tax consultancy. Any legislative changes can have ripple effects on liability with professions.

However, a July 2024 article from Marsh has highlighted “forward movement in the PI market”. This is partially due to the reduction of challenges in the hard market (low insurer appetite, restrictions), consequently leading to more professionals being considered for PII by insurers.

Compliance can also play a role in affecting the market. As institutions change their T&Cs, insurers may limit their offerings to the given sector. For instance, if the Solicitors Regulation Authority or Legal Services Board made changes in order to provide better coverage, insurers may not be prepared to offer the best policies to those in the legal profession.

A 2023 article from Zurich highlighted the risk factors that could affect the market in in 2024, with such considerations as cyber-attacks and insolvencies. There is an ongoing threat of cyber-attacks to the legal sector, as they deal with finances and highly confidential information.

This could drive up insurance costs for the legal sector, but there are other threats to industries such as the construction industry. The article reads “The rise in BLOs will invariably lead to considerations as to the scope and intention of the insuring clause for Insurers”. This is in reference to Building Liability orders, mechanisms of preventing building companies from eschewing liability.

Professional Indemnity Insurance costs

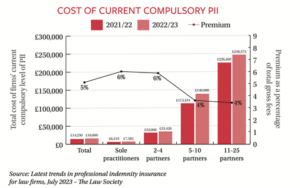

As this is often an essential purchase, it is important to consider the costs involved with PII. An analysis of law firms in the UK by Frontier Economics found that “between 3% and 9% of law firms’ annual turnover” goes to PII premiums, and there was a “median value of 5%”. This can vary depending on a wide range of factors, such as the number of partners in the firm (see below).

While amount of cover can vary, there is a minimum level of cover that a professional body requires in the legal sector. There is a mandatory level of insurance which is currently at £2 million. This can often be a burden for small businesses when they are required to buy professional indemnity insurance.

You can arrange this coverage through insurers which offer professional indemnity insurance, typically accessed through a broker, who may give an online quote.

Even if professional indemnity insurance is not a requirement for your business, it can be very useful and worth considering. The peace of mind that your legal and financial interests will be protected is a worthwhile investment, and it can even make the business look more professional to prospective clients.

Some top tips from The Law Society include: start the renewal process early to capitalise on the improving market conditions, and take the time to prepare a detailed presentation for insurers. This can improve the chances of getting approved for professional indemnity insurance; therefore streamlining the process further.

Rather than paying this annual cost up front, you could break it down to monthly payments. White Oak UK can facilitate this through alternative finance. We offer a variety of solutions to assist your business, and you can find more information here.

Conclusion

The key to understanding PII is making sure you know whether your business needs it, and how much it costs. The industry changes frequently because of a range of external factors. It is important to stay ahead, understanding how those changes could affect you. Remember, financing your PII can make this valuable insurance product much more affordable. This could be indispensable to reinforcing your business’ cash flow.

Are you interested in this service? Please contact us via our website or call us on 0333 014 9000, and get affordable PII for your business.

Talk to us

If you are looking to find the right finance for your business, contact us today.

Discover the right business products all in one place.

Tell us about your business.